AI and the Changing Role of the CFO

Robots are taking over. It’s an alarmist stance, but we see it everywhere. Factories and drones, surgery and shipping: The rate at which we develop more sophisticated machinery (particularly through AI) is snowballing. Right now, for every new robot introduced, the workforce loses 5.6 human workers, according to The National Bureau of Economic Research. Automation is the wave of the future, and AI will have an impact on every job, in every industry.

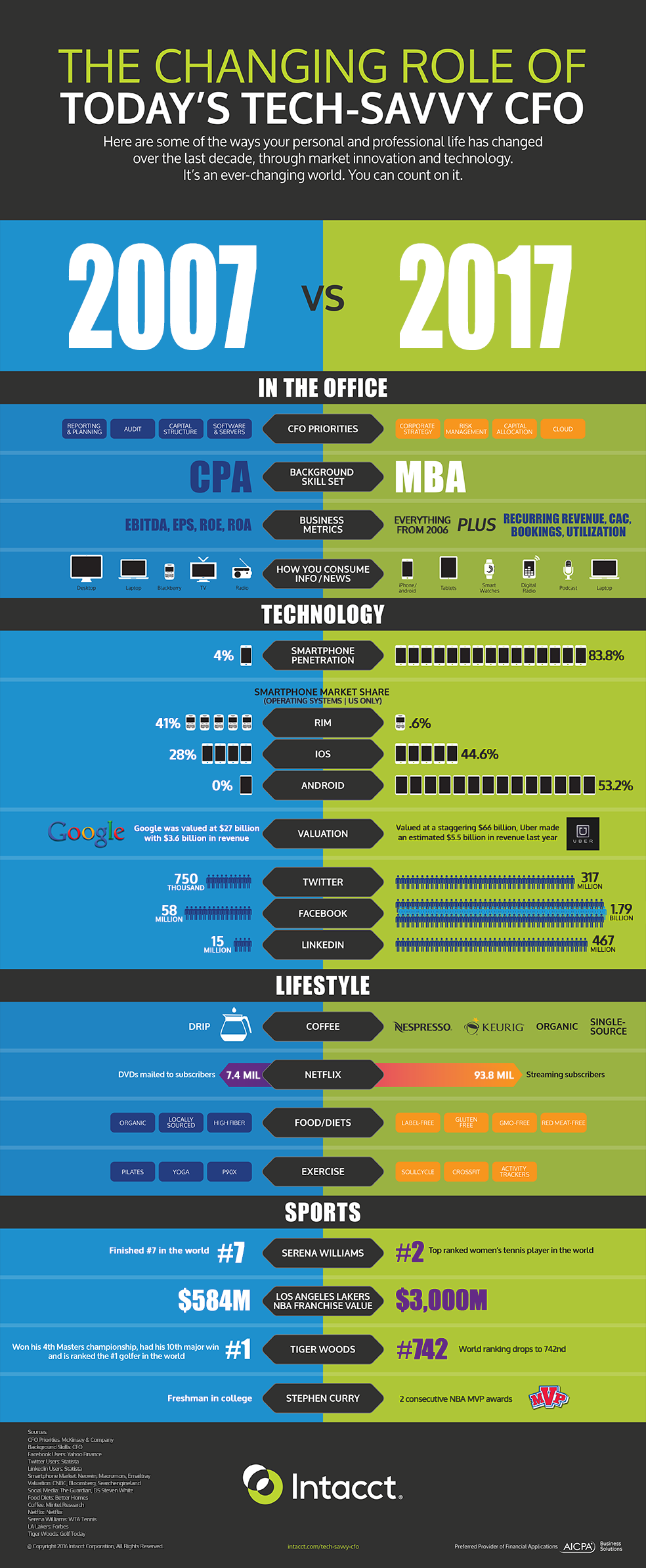

The question is, what kind of effect has this had on the role of CFO? As a financial risk manager, you’ve seen some major changes in how technology has shifted the dynamics of your role. Sage Intacct recently released an infographic showing some of the major technological shifts in how CFOs function. (See the full infographic.)

Technology Jump

A decade in the tech world can feel like eons. Smartphone penetration has gone from 4% to more than 80% in just one decade, with iOS and Android, which had little to no impact on the market back in 2007, to nearly cornering all smartphone operating systems between the two of them. Google 10 years ago was valued at $27 billion, with $3.6 billion in revenue. This seems like chump change compared to their current $101 billion valuation and their $80 billion in revenue.

In fact, out of the top 10 most valuable brands in the world, technology takes up six spots, with Apple, Google, Microsoft, Facebook, Amazon and Samsung.

Social media is dominating the attention of the world, with well over a billion people on Facebook and other platforms.

As a CFO, you have to incorporate how the world functions into your planning because your business relies on its ability to target an audience and reach customers.

How You Do Business

But the role of CFO has also changed with technological advances. CFO priorities used to be reporting and planning, audits, capital structures, software and servers. Now, CFOs are playing a much broader part in business structures, including corporate strategy, risk management, capital allocation and cloud technologies. Because of this, more companies are looking for CFOs with an MBA background as opposed to the old standard CPA model.

As CFO, you’re expected to use business metrics like EBITDA, EPS, ROE and ROA in addition to recurring revenue models, CAC, bookings, and utilization.

Technology is changing, and the CFO role, like many other roles, is a great target for the oncoming wave of more human-like automation of processes. With new technology, CFOs are seeing the number of spreadsheets they work with daily shrink, they’re seeing scalability without the substantial capital expenses that usually hit the financial team. Finally, it’s an ability to analyze data with faster turnarounds.

Learn How Artificial Intelligence is Driving the CFO of Tomorrow

It’s a new world for CFOs. To meet the increasing demands of the role, it’s essential for the modern CFO to have the right technology to rely on. Call us to find out how you can harness the latest financial technology for your business.