Sage Intacct R2 2022 Update: A WHOLE NEW MODULE?!?

Sage Intacct updates four times per year, each time advancing a mature product more and more into the future. Whether it’s GL Outlier detection to have artificial intelligence flag entries that have gone astray, or bank feeds to give constant and automated visibility into cash positions (free download), each quarter Sage Intacct customers get new features. This time it’s the Sage Intacct R2 2022 update.

But a whole new module? Whoa.

No, this isn’t the first time that this has happened, but yes, all Sage Intacct customers get a built-in dunning notice feature in addition to much, much more.

The full release notes have been published, but we’ll list off our top two features here.

Accelerate Your Cash

Why not start with that new feature? Sage Intacct already had a full collections module for companies with collection departments and robust cash requirements. Organizations who also assign collection tasks, prompt internal users to follow up on past due invoices and communicate progress internally have had a collections module speed up the quote-to-cash cycle.

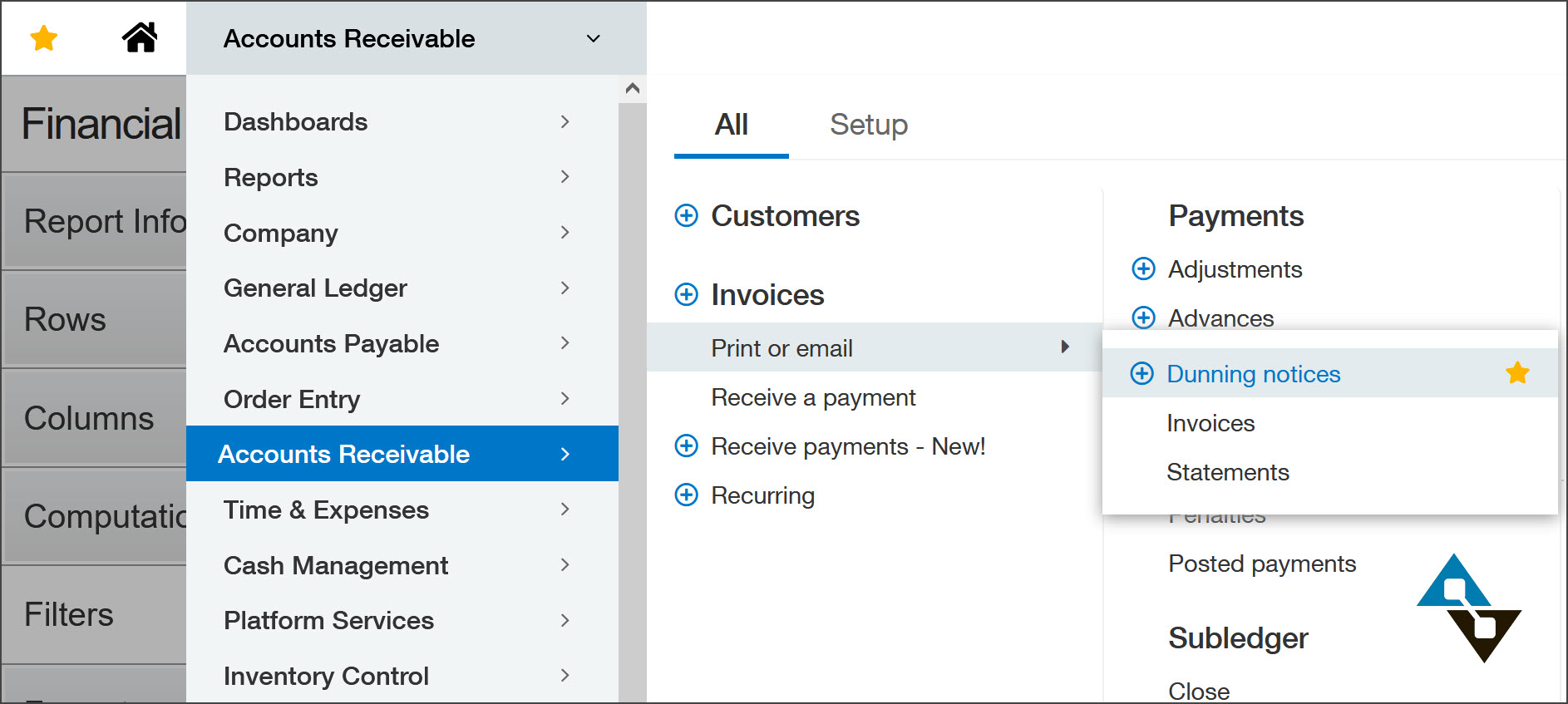

But some companies need just one part of that functionality: Dunning Notices. A Dunning Notice is a delightfully old-timey phase that means sending notes to customers regarding past due invoices. Traditionally these notices start as a simple reminder (“In case you overlooked these invoices, we’re attaching these here for your review…”) and escalating to something stronger as they remain open (“Until these past-due invoices are addressed we may be forced to suspend future services…”).

Now, with core functionality, all Sage Intacct subscribers can send these dunning notices to their customers to speed up the cash cycle. The notices can be tailored for precise wording and customers who receive the notice can be controlled.

Using this feature means turning cash around just that much faster.

Automating Bank Fixes

We showed a YouTube video about how to set up an advanced bank reconciliation in even the messiest of environments. In that video we go through setting up rules to reconcile tricky real-world examples so we can free up users to spend less time ticking boxes in a bank rec and more time leveraging their intellect and skill.

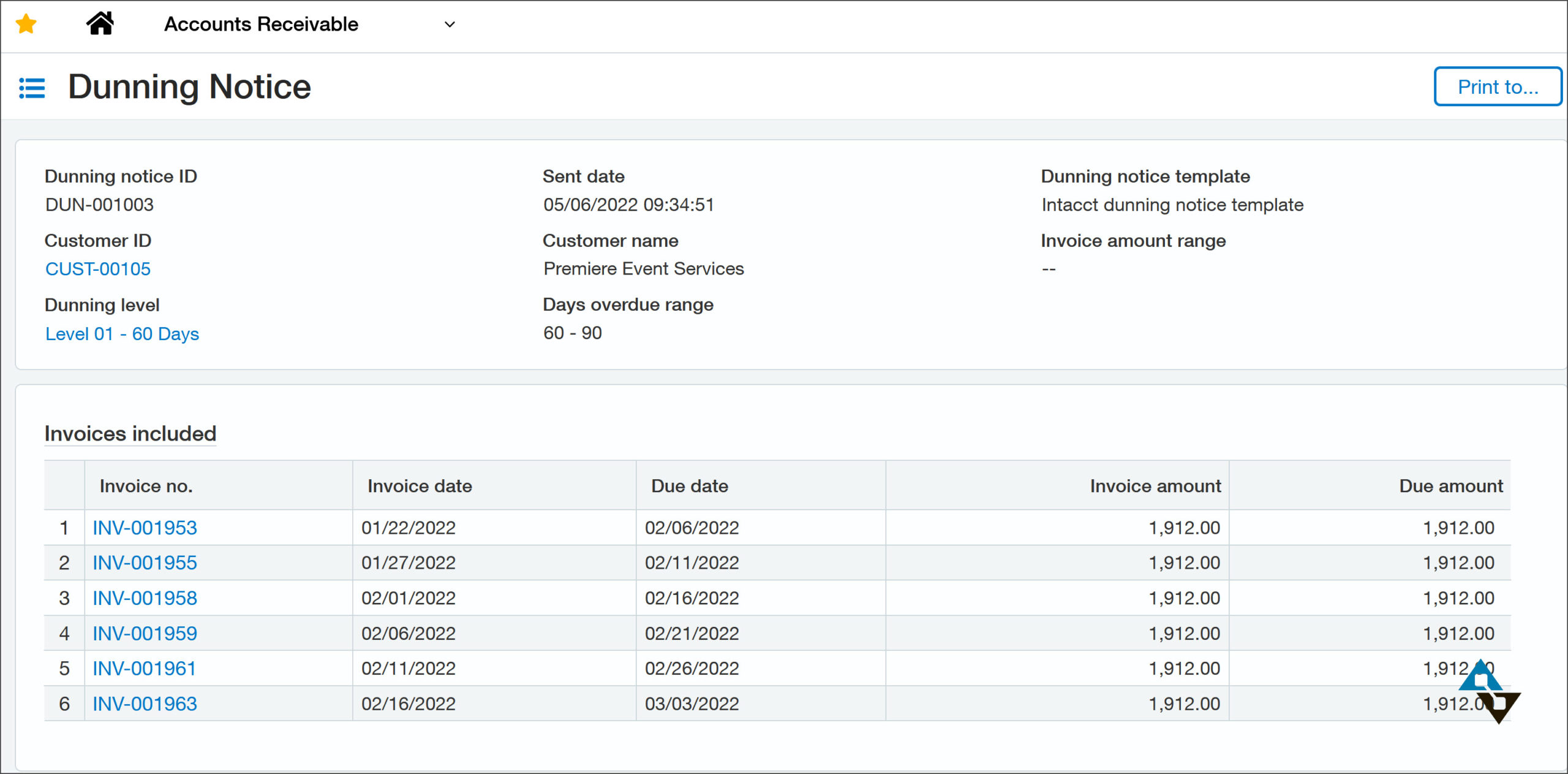

This quarter we get to go one step further and have the system start booking GL entries automatically.

Most organizations have a handful of transactions that are authorized to automatically withdraw or deposit to their banks. Sometimes these amounts vary (interest income, for example) but regardless we must make an entry based on the bank activity. Now we can set up rules to detect specific entries and automate the journal entry.

We accountants are inching closer to the day where the only thing we need to do on a bank rec is look for an exception, and after seeing none, move on.

Then again, maybe we’re there already.

Wait, There’s More?

Sadly, the Sage Intacct R2 2022 update has more than we can cover in detail here. If it all seems like too much, fear not, Alta Vista Technology customers are invited to free quarterly webinars to learn more still. Give us a call at 855.913.3228 or fill out our simple web form and someone will reach out to you within one business day to share more about Alta Vista Technology and Sage Intacct.