How to Process 1099s in Sage Intacct

Our reward for surviving another year is getting to process 1099s and 1096s in Sage Intacct. Or so we’ve been told.

Steps by step instructions on how to process 1099s in Sage Intacct can be found on this page, but we also have a video with Dave, our resident YouTube celebrity.

Steps for a successful year-end:

Let’s get started.

Confirm Vendors are Correctly Tagged

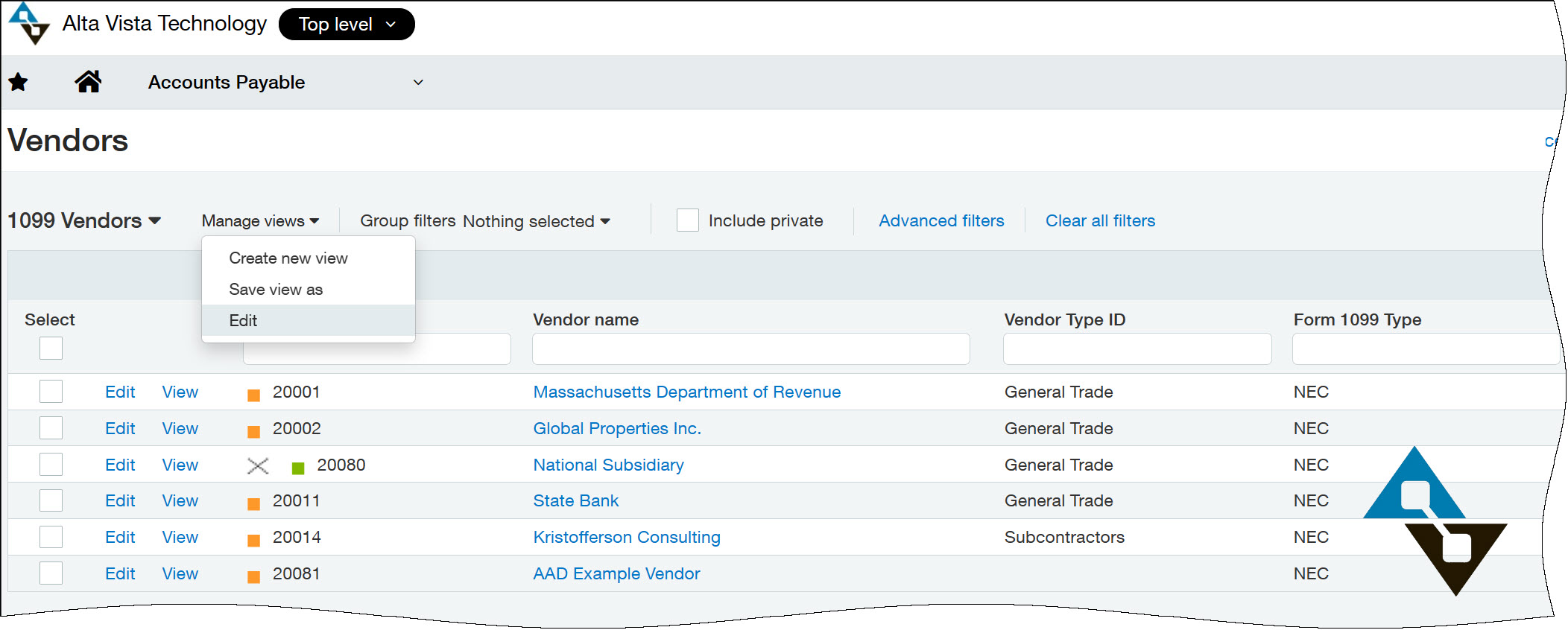

Sage Intacct has native functionality called a “view” where you can control what information you see and how it’s filtered. Take this “1099 Vendors” view:

This view is set to show just 1099 vendors and their form type and box number. Scanning a list like this, both with the filters in place and without, will tell you whether vendors are set up in the system correctly today.

This doesn’t confirm whether they were *always* set correctly, but this is an important step not to be overlooked.

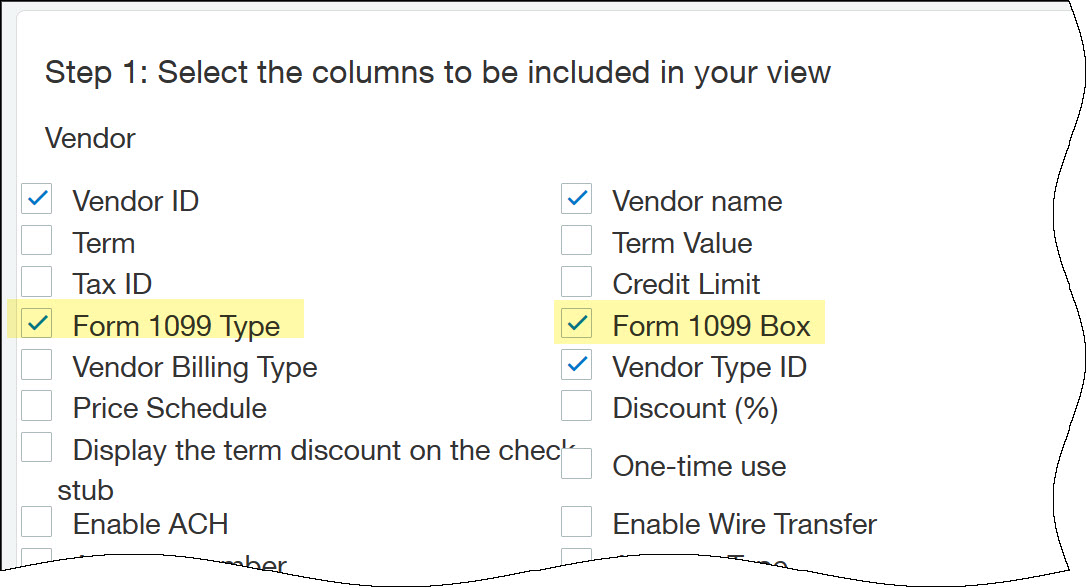

To make the view, click the Manage Views option on the Vendors screen. This is a step-by-step wizard to make the view, but two critical parts are worth calling out. First, pick 1099 info and other relevant information to show:

You may consider adding address information, tax ID numbers, and the like, but add any additional fields that help you understand that the vendors have been created correctly.

Optionally, you might want to also filter the view to *just* show 1099 Vendors. (Note: it’s probably best to have two views, one with the filter and one that shows all vendors to spot any vendors who may have been overlooked.)

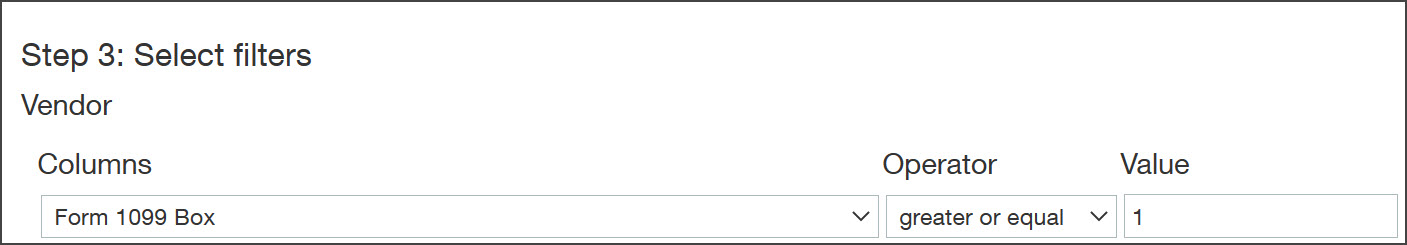

The filter logic may not be obvious:

By showing vendors with a 1099 Box greater than or equal to 1, we just see the 1099 vendors.

But what if a vendor is incorrect?

Correct Vendor History

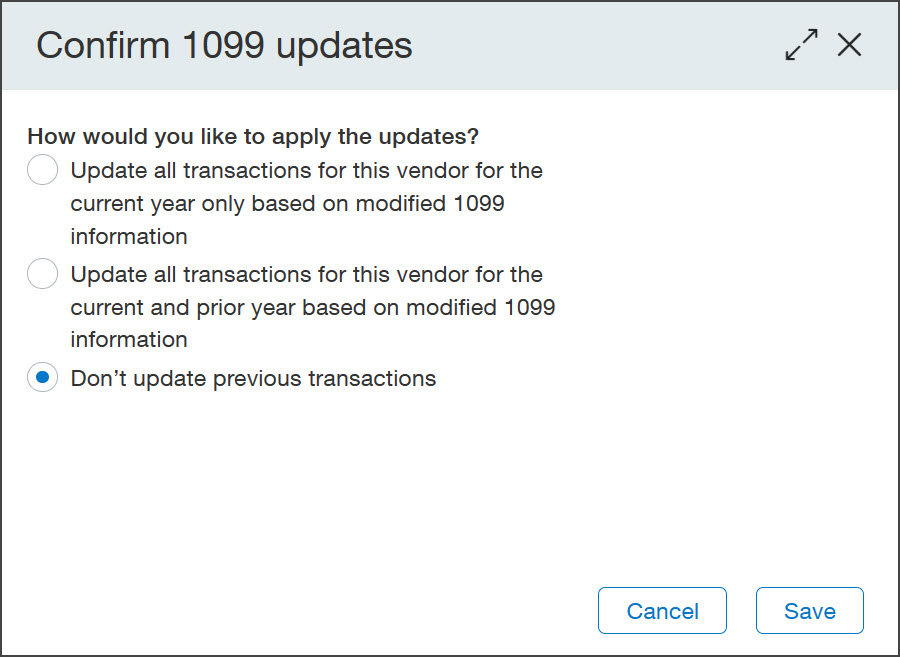

Editing any vendor, you can correct the 1099 form and box. When you hit Save on the vendor record, you will get the following dialog if there’s history:

Just like it reads, you can conveniently tell the system to update historical transactions based on your changes. This is sooooo helpful. If you have a vendor here or there that you want to fix, this is an easy way to make your corrections.

Alternatively, let’s supposed you acquired a company mid-year and created dozens of vendors incorrectly… going one at a time would be painful. That’s why you can import your corrections, too!

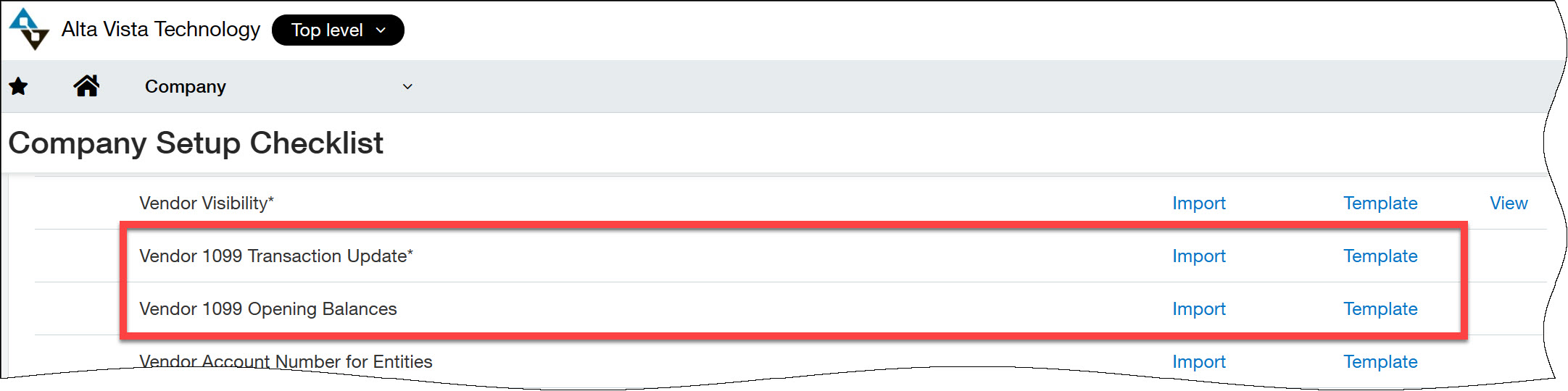

Under Company > Import Data, you can navigate to the options shown here to import corrections. The Opening Balances option would be best if you are just starting out in Sage Intacct and have 1099 information that originated outside of Sage Intacct. The Transaction Update, like the name implies, will allow mass changes to 1099 transactions.

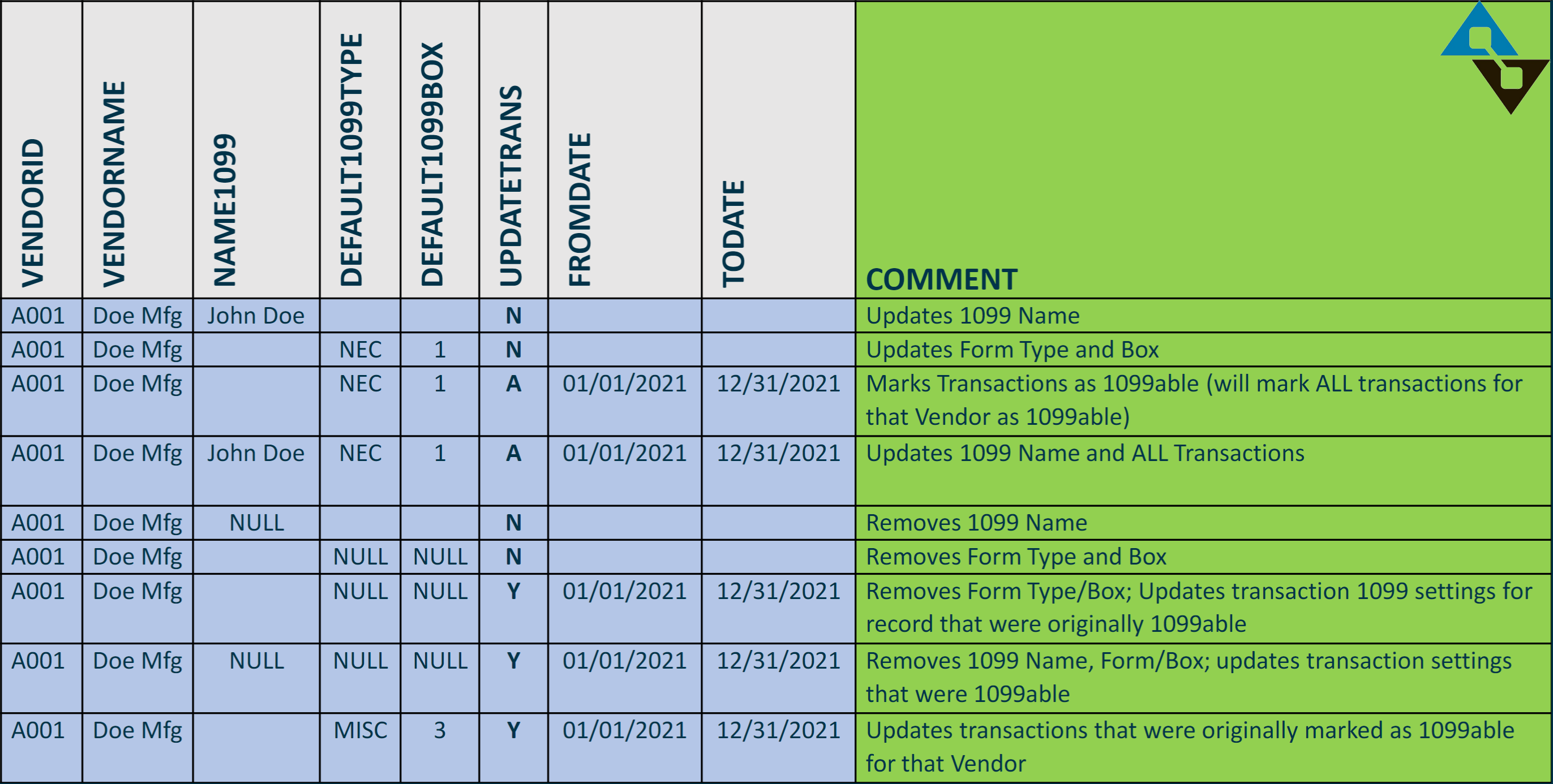

With much thanks to the team at Sage Intacct, the above shows how the Transaction Update can be used to update any combination of history – from certain transactions to all.

Between the mass updates and individual corrections, you’ll be confident in the numbers.

But are you?

Run Verification Reports

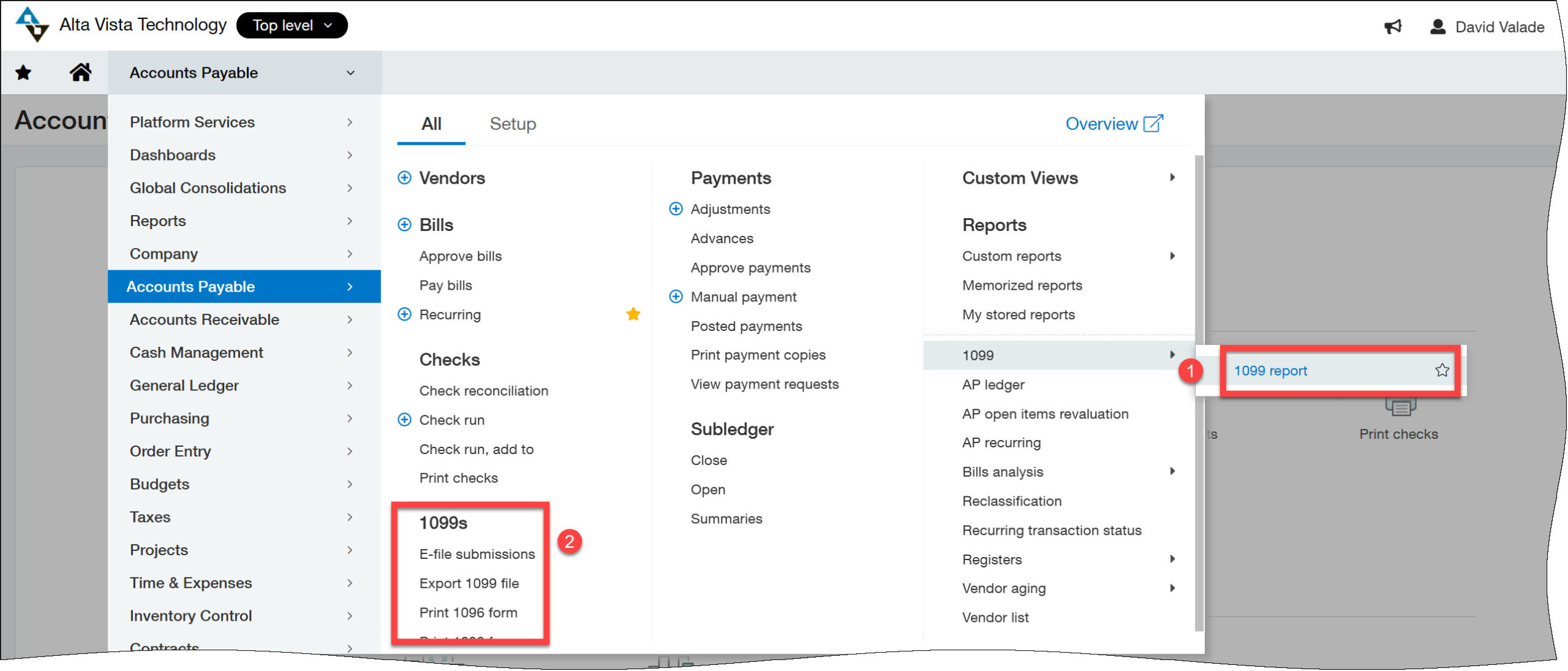

The 1099 option shown under (1) below, is your best friend:

This report lets you:

- Pick a date range to review the reporting year

- Select the forms you want to review (NEC? MISC? All of them? You pick!)

- Run the report in Detail or Summary

- Show only 1099 transactions, or include other transactions as well

This report is great because you can drill in on a detailed transaction and reclassify anything that looks incorrect. Take your time with this report, it’s really great.

Print or E-File

Shown in (2) above, you can print your 1099s and 1096, or export a file. Pick the forms you want to print and off you go. A newer option was introduced, however, that allows users to push information to marketplace partner TaxBandits.

Users can decide how much they want to lean on TaxBandits. They can print and deliver 1099s, or just electronically file with the government, or any combination.

Note: if you don’t see an option to E-file, you can enable this functionality through the AP Configuration menu.

And… you’re done!

Need a Hand?

If this is all too much, that’s ok, we’re here to help. For more information on how to process 1099s in Sage Intacct, get in touch with us by phone at 855.913.3228 or fill out our simple web form and get a spot on our calendar today!