On-Premises Systems Are Killing Your Year End Close

The year-end close is known as a necessary evil in accounting. But does it have to be?

Even in the relatively stable world of accounting, the process of the year-end close, even for mid-sized businesses, has gone through a transformation. As technology automates processes the need for a faster year-end close has exploded, all while maintaining the high standards of accuracy accountants are accustomed to demanding of themselves.

The Long Road to Year-End

In years past using on-premises accounting software, a year-end close process might have included steps like these:

- Accrue liabilities based on external information

- Make adjusting entries to a fictitious 13th month

- Perform external adjustments that might affect other books (GAAP or IFRS)

- Assure all batch-bound transactions are posted

- Close sub-ledgers

- Investigate accounts for errors or mistaken entries

- Perform software updates

- Close general ledger

- Run reports for management

But much of this is related to legacy systems. For example, if we can see all adjusting entries separately, do we need a fictitious 13th month? If we migrate from our older on-premises system to a cloud-based system, we can do away with software updates and backups since those steps happen automatically.

Taking the High Ground

Even better, with systems like Sage Intacct, we can move to a real-time system that favors a “perpetual close” where transactions happen without batches, reports are distributed automatically or retrieved in a user-friendly self-service nature.

Getting to a faster and more painless year-end close is more real than many realize. Software can keep lean accounting teams moving quickly, setting workflows and rules to ensure accurate postings, and provide information to management while the information is still relevant.

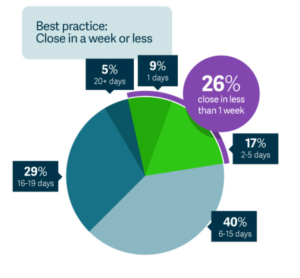

Today, studies show 26% of accounting systems are able to close in less than 1 week. That’s a best-practice, to be sure, but the number of companies able to close in 1 day has climbed to 9% and still growing.

Today, studies show 26% of accounting systems are able to close in less than 1 week. That’s a best-practice, to be sure, but the number of companies able to close in 1 day has climbed to 9% and still growing.

All of this makes sense, of course. If systems are cloud-based, the backups and upgrades happen automatically without down-time. Updates happen unattended (1099 limits, daily multi-currency rate changes, and so on). Furthermore, if rules exist controlling the inputting of data then fewer mistakes are made in the routine course of business which means less time devoted to corrections. Letting management see information as it evolves and allowing the ability to drill into transactions to answer questions or pose them as events unfold means that potentially confusing topics are addressed early.

Is your ERP system making the grade?

Want more information about how you can slash your year-end-close to less than a week? Give us a call at 855-913-3228 or shoot us an email at info@altavistatech.com. We take pride in being part of your solution!